This innovative fund seeks to merge two essential investment strategies?alpha generation and low volatility?to build a well-rounded portfolio that aims to provide excellent returns while minimizing risk.

Understanding the Investment Strategy

Factor-Based Investing

The fund utilizes a multi-factor investing strategy, concentrating on several important characteristics:

- Low Volatility: It targets stable companies that experience less price fluctuation.

- Alpha: It selects stocks with a strong potential for generating excess returns.

By combining these factors, the fund strives to improve diversification and optimize portfolio results, thus lowering overall volatility while capturing alpha.

Nifty Alpha Low-Volatility 30 Index

The foundation of this index comprises 30 stocks chosen from the Nifty 100 and Nifty Midcap 50 indices. The selection criteria emphasize:

- **High Jensen?s Alpha:** Stocks are picked based on their historical performance compared to market benchmarks.

- **Low Standard Deviation:** Preference is given to stocks that have shown stable returns over the past year.

This dual focus enables the fund to potentially outperform broader market indices while keeping a lower risk profile.

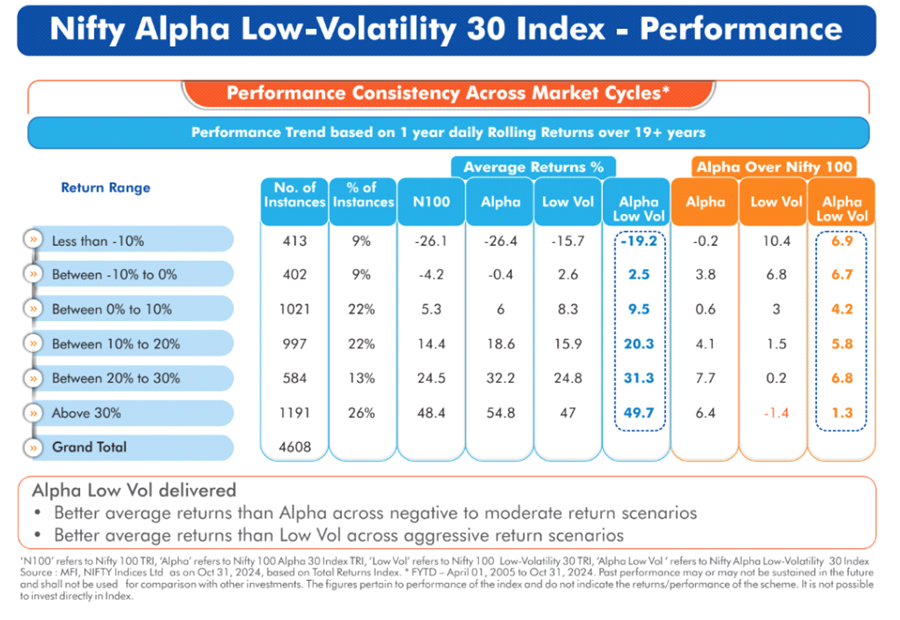

Performance Insights

Historical performance data indicates that the Nifty Alpha Low-Volatility 30 Index has consistently achieved:

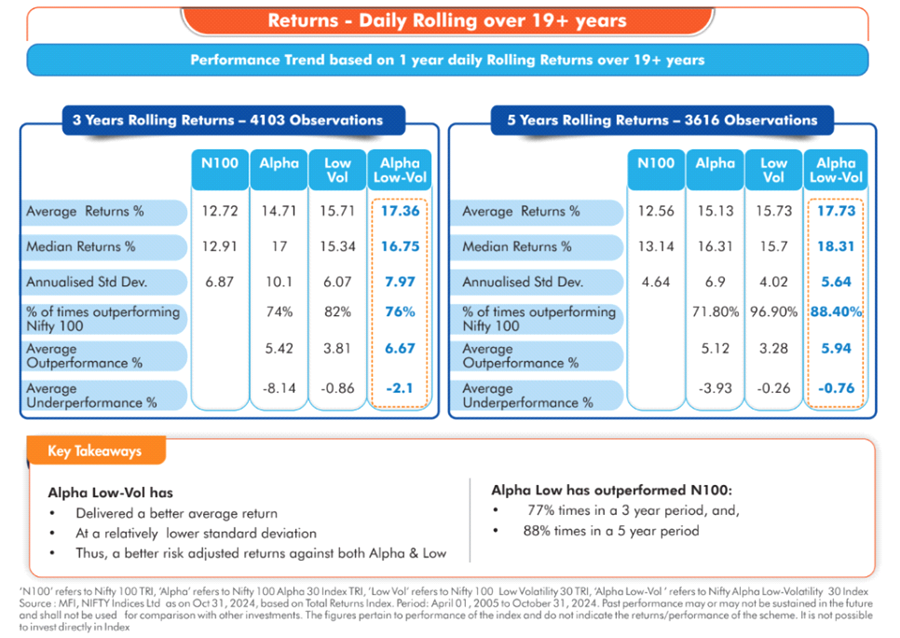

Higher Returns: An annualized return of around 20.20%, surpassing the broader Nifty 100 TRI's 15.10%.

Lower Volatility: The index has shown a volatility level of 17.50%, which is less than that of the broader market, suggesting a more stable investment choice.

Risk-Adjusted Returns

- The index has outperformed the Nifty 100 TRI under various market conditions, demonstrating resilience during downturns and superior gains in bullish periods.

- It has maintained an impressive consistency rate, outperforming traditional indices in over 74% of observed instances across different time frames.

Why Choose UTI Nifty Alpha Low-Volatility 30 Index Fund?

Enhanced Diversification: By investing in multiple factors, this fund lessens dependence on any single investment strategy.

Stable Growth Potential: The emphasis on low-volatility stocks helps safeguard capital during market declines while still pursuing growth.

Low Cost: As a passive fund, it features a very low expense ratio.

Should you invest in this fund?

Investing in the UTI Nifty Alpha Low-Volatility 30 Index Fund is particularly suited for:

Long-Term Investors: Those who are looking to build wealth over time and can withstand market fluctuations will benefit from the fund's potential for higher returns combined with lower volatility.

Risk-Averse Individuals: Investors who prefer stability and want to minimize the impact of market downturns will find this fund appealing due to its focus on low-volatility stocks

Diversification Seekers: This fund is ideal for investors looking to diversify their portfolios with a multi-factor approach, as it combines alpha generation with low volatility, providing exposure to various sectors and stocks.

long term Lumpsum investor: Those who are thinking for long term lumpsum investments with lower risk can definately consider this product to enhanse their portfolio return.

In conclusion, the UTI Nifty Alpha Low-Volatility 30 Index Fund is an excellent choice for long-term, risk-conscious investors seeking a balanced approach to growth and stability in their investment portfolios.

Disclaimer : Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.