Rajesh Javia

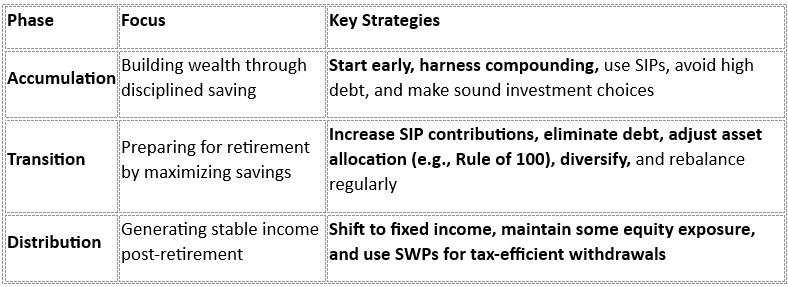

Retirement planning isn?t just about putting money aside?it's a strategic, multi-stage journey that involves smart saving, thoughtful investing, and risk management to ensure financial security when you retire. The process can be broken down into three main phases: Accumulation, Transition, and Distribution.

Under the new tax regime, only selective exemptions and deductions can be claimed. Before we delve into the specifics, let?s revisit some essential points .

I.Accumulation Phase (Building Your Wealth Early On)

This phase focuses on building wealth through disciplined saving and investing. Starting early is crucial because of the power of compounding, where your money earns interest on interest, significantly boosting your long-term savings.

Key Highlights:

Start Early:

- Benefit: More time for compounding to work its magic.

- Example: Reinvesting profits in equity mutual funds can create a snowball effect over the years.

Be Disciplined in Saving:

- Avoid Common Pitfalls :

- Not Saving Enough: Lifestyle expenses can curb your ability to save.

- Compulsive Spending: Impulse purchases can derail your savings goals.

- Credit Card Debt & Over-Extension: High debt burdens (ideally, EMI payments should not exceed one-third of your income) reduce the money available for investments.

- Wrong Investment Choices: Align your investment choices with your risk tolerance; for instance, don?t expect equity-like returns from fixed income products.

Systematic Investment Plans (SIPs):

- Why SIPs? : They help you develop a disciplined saving habit and harness the benefits of early investing.

- Tip: "Starting a SIP at the beginning of the month can be a good tactic to get into a disciplined savings habit."

Regular Monitoring:

- Action: Periodically review your portfolio to adjust plans, rebalance asset allocations, and align with changing life circumstances.

Challenges to Consider:

- Increasing Longevity: Retired life can span 25?30 years, requiring substantial savings.

- Inflation & Rising Healthcare Costs: These factors can erode your savings over time.

- Lifestyle Expectations: Changes such as later marriages or having children may impact your saving strategy.

II. Transition & Distribution Phases (Preparing for and Living in Retirement)

Transition Phase (Approximately 10 Years Before Retirement)

As you approach retirement, this phase is about maximizing savings and adjusting your financial strategy to reduce risk.

Focus Areas:

Boost Savings:

- Increase your SIP contributions or opt for SIP top-ups.

Eliminate Debt:

- Work towards becoming debt-free to enhance your investable surplus.

Adjust Asset Allocation:

- Use guidelines like the "Rule of 100" (equity allocation = 100 - age) while considering your unique financial situation.

Diversify Investments:

- Consider adding assets such as gold and international equities.

Rebalance Regularly:

- Ensure your portfolio remains aligned with your evolving risk profile.

Distribution Phase (Post-Retirement)

After retiring, your primary goal shifts to generating a stable, regular income while preserving your capital.

Focus Areas:

Shift to Fixed Income:

- Action: Increase allocation to low-volatility assets to generate steady cash flow.

Maintain Some Equity Exposure:

- Reason: To help your portfolio keep pace with inflation.

Tax-Efficient Withdrawals:

- Consider methods like

Systematic Withdrawal Plans (SWPs), which can be more tax-friendly depending on your income bracket and investment type. These strategies are in line with recommendations from the Budget Speech 2024-25.

Focus on Cash Flow:

- Ensure your investments provide regular income to cover your ongoing expenses.

III. Comparison Table: Phases of Retirement Planning

Final Thoughts

Retirement planning is a dynamic process that evolves with your personal and financial journey. By starting early, staying disciplined, and adapting your strategy as you move through different life stages, you can build a solid financial foundation that supports your retirement dreams. Remember, the focus during the accumulation phase should be on saving and investing in a disciplined way, setting you up for a secure and fulfilling retirement.

This engaging guide aims to provide you with a clear roadmap to navigate your retirement planning effectively. Enjoy planning for a secure future!

Disclaimer : Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.