Rajesh Javia

When Donald Trump stormed into the White House for his 2024 term, he wasted no time in shaking up the global economic landscape. One of his key campaign promises was to "protect American jobs," and he's sticking to that script by doubling down on tariffs. But what does this mean for global markets, and more importantly, for Indian investors?

###**What's the Deal with Tariffs?**

In simple terms, tariffs are taxes on imported goods. For instance, if the U.S. slaps a 25% tariff on Indian steel, American companies importing it would have to pay extra. This makes Indian steel more expensive in the U.S., nudging buyers to consider local or non-tariffed options.

On paper, this sounds like a win for American manufacturers. But in reality, tariffs are like throwing a rock into a pond - they create ripples that affect everyone. Supply chains get disrupted, export-driven economies take a hit, and financial markets get jittery. For a country like India, which thrives on sectors like IT, pharmaceuticals, and textiles, this could spell trouble.

###**The Bigger Picture: Why Is Trump Doing This?**

Trump's tariff strategy isn't just about protecting American jobs - it's part of a larger economic game plan. Here's the gist:

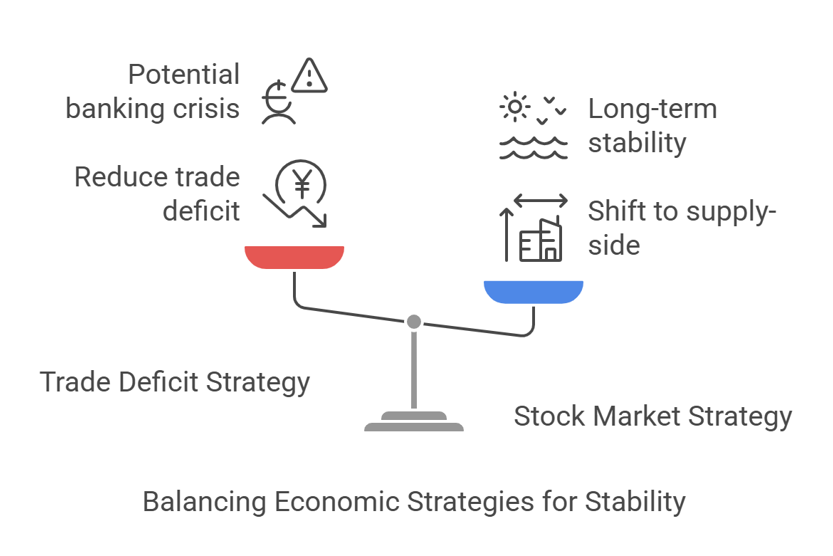

**The Trade Deficit Problem**

The U.S. buys way more from China than it sells to them, leading to a trade deficit. China then uses these surplus dollars to buy U.S. Treasury bonds, essentially lending money back to America. By imposing tariffs and reducing imports, Trump hopes to shrink this deficit. But there's a catch - less money flowing into U.S. banks could trigger lower profits and even another banking crisis.

**The Stock Market Puzzle**

While Trump promised to boost stock markets during his campaign, his actions seem to suggest otherwise. In fact, some believe his administration is deliberately allowing the market to fall. Why? To shift the U.S. economy from being consumer-driven (demand-side) to one powered by businesses and investments (supply-side). It's a bold move aimed at resetting inflated asset prices and paving the way for long-term stability.

**The Debt Dilemma**

The U.S. debt is a staggering $34 trillion, with $7 trillion needing refinancing soon at sky-high interest rates. A falling stock market could actually work in Trump's favor here. When markets dip, investors often flee to safer assets like U.S. Treasury bonds. This increased demand pushes bond prices up and yields (interest rates) down, saving billions in refinancing costs.

Final Thoughts

##**How Tariffs Fit Into the Plan**

Tariffs are Trump's way of keeping everyone on edge. By making imports more expensive, they theoretically drive up inflation. But here's the twist?investors are more spooked by the uncertainty surrounding tariffs than by inflation itself. As they dump stocks and buy bonds, Trump gets exactly what he wants: lower bond yields.

It's almost like controlled chaos. Every time Trump tweaks his tariff policies, markets react. And while it might seem erratic, there's a method to the madness.

##**What About Government Spending?**

Another piece of Trump's economic puzzle is slashing government spending. His administration is cutting jobs, reducing programs like Medicare and food assistance, and shrinking housing aid. The goal? To wean the economy off its dependence on public spending and shift growth back to businesses.

On the flip side, Trump is rolling out tax breaks for corporations and easing regulations in hopes that businesses will pick up the slack. It's a high-stakes gamble that could either rejuvenate the economy or tip it into recession.

##**Will This Work?**

This strategy - often referred to as "kitchen sinking" - involves frontloading economic pain now for potential long-term gains. But it's not without risks.

**Recession Worries**

Markets are already on edge. Canada has threatened to cut electricity exports to the U.S., and prediction markets like Kalshi peg U.S. recession odds at 40% this year. If businesses hold back on investments due to uncertainty (like Pittsburgh-based aluminum giant Alcoa has hinted), the economic slowdown could deepen.

**Impact on Everyday Americans**

A crashing stock market doesn't just hurt Wall Street - it hits Main Street too. Retirement savings take a beating, and consumer confidence wanes. Restructuring an economy isn't an overnight process; it's messy and political, with plenty of collateral damage along the way.

##**What Should Indian Investors Watch?**

For Indian investors, Trump's tariff tactics are a double-edged sword.

**Export-Driven Sectors at Risk**

Industries like IT, pharmaceuticals, and textiles could face headwinds if tariffs make Indian products less competitive in the U.S.

**Global Market Volatility**

Tariff wars create uncertainty in financial markets worldwide. For Indian investors with exposure to global equities or commodities, this could mean heightened volatility.

**Opportunities in Bonds**

On the flip side, falling U.S. bond yields could present opportunities for fixed-income investors looking for safer bets.

##**The Road Ahead**

Trump's approach is bold, chaotic, and polarizing. Supporters argue that short-term pain will lead to long-term gains with lower interest rates and stronger business investment benefiting everyday Americans. Critics warn that this gamble could backfire, pushing the economy into recession and leaving millions worse off.

For now, all eyes are on how markets react in the coming weeks as interest rates shift and new policies unfold. One thing's for sure?Trump's economic experiment is far from over.

Will it pay off or blow up? Only time will tell.

Disclaimer : Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.