Stock market corrections are often viewed with trepidation by investors, but they are a natural and essential part of the investing landscape. Defined as a decline of 10% or more from a recent peak, corrections serve to realign stock prices with their intrinsic values and prevent market bubbles from forming. This article explores the historical context of market corrections, examples from the past, and the importance of maintaining a long-term perspective.

The Nature and Causes of Market Corrections

Corrections can arise from various factors, including:

- Profit Booking: After a significant rally, investors may sell off portions of their holdings to lock in gains, leading to downward pressure on prices.

- Economic Indicators: Poor economic data can trigger fears about future growth, prompting investors to reassess their positions and sell.

- Geopolitical Events: Political instability or trade tensions can create uncertainty, causing investors to pull back.

- Investor Sentiment: Emotional reactions driven by fear or greed often exacerbate selling during corrections.

Historically, corrections have been seen as healthy for markets. They allow for necessary adjustments to overvalued assets and create opportunities for long-term investors to buy at lower prices.

Historical Examples of Market Corrections.

Examining historical data provides insight into how markets have reacted during corrections:

- The Dot-Com Bubble (2000-2002): After reaching unprecedented heights in the late 1990s, the NASDAQ Composite index fell approximately 78% from its peak by 2002. This correction was painful but ultimately laid the groundwork for a more sustainable market recovery.

- The Financial Crisis (2007-2009): The S&P 500 experienced a decline of over 50% at its lowest point during the crisis. However, the market eventually rebounded, leading to one of the longest bull markets in history.

- Recent Corrections: In August 2022, the NASDAQ entered correction territory after declining 10% from its peak earlier that year due to concerns over economic growth and Federal Reserve policy changes[2][3].

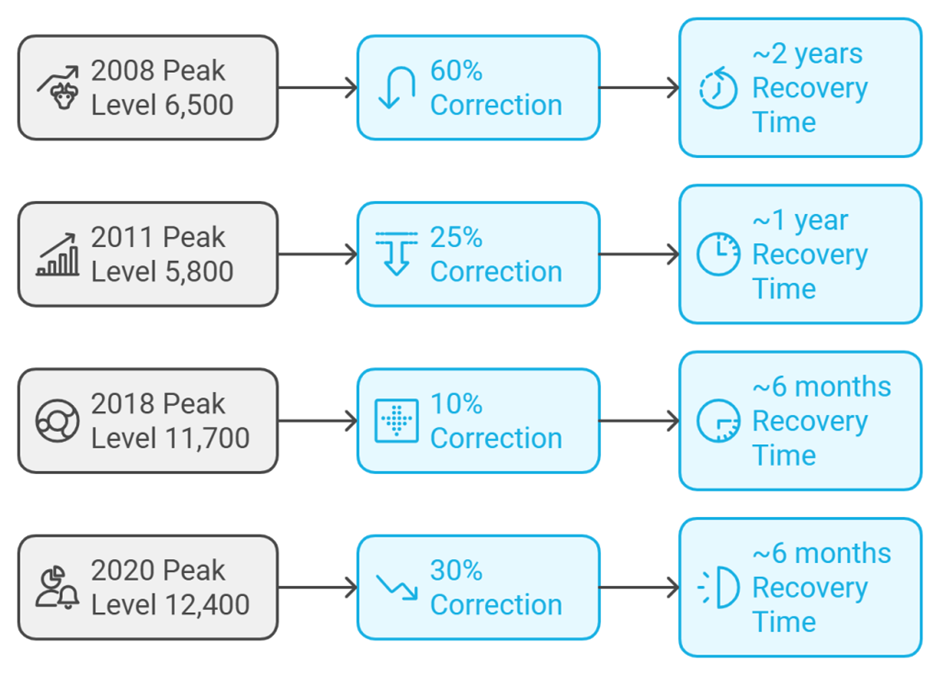

Long-Term Nifty Performance During Corrections

The Nifty 50 index in India has also experienced several corrections throughout its history. Below are key points illustrating how corrections have occurred within its long-term growth trajectory:

These historical corrections highlight that while short-term declines can be severe, the overall trend for indices like Nifty has been upward over the long term.

The Importance of Patience and Long-Term Investing.

Legendary investor Warren Buffett famously stated, ?The stock market is designed to transfer money from the Active to the Patient.? This quote encapsulates the essence of investing through corrections. Patient investors who resist the urge to panic sell during downturns often reap significant rewards when markets recover.

Investors should focus on:

- Staying Invested: Maintaining a long-term perspective allows investors to ride out volatility.

- Rupee-Cost Averaging : Regular investments during corrections can lead to purchasing more shares at lower prices.

- Diversification: A well-diversified portfolio can mitigate risks associated with market downturns.

Disclaimer : Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.