When it comes to investing in mutual funds, one of the biggest dilemmas people face is: Should I go for an active fund or a passive fund? This debate isn?t new, and like choosing between chai or coffee, it all boils down to personal preference and needs. Let?s explore this in detail (without boring you, I promise!).

What Are Active and Passive Funds?

- Active Funds: These are like a chef in a gourmet kitchen. Fund managers actively manage these funds, picking stocks or bonds they believe will outperform the market. Naturally, you pay them a higher fee for their expertise.

- Passive Funds Think of these as a buffet?no frills, no chef recommendations. Passive funds simply replicate a market index, like the Nifty 50 or Sensex, and aim to match its performance.

Performance Check: India vs. Developed Markets

In India, active funds have traditionally outperformed passive funds, thanks to our market's inefficiencies. Many fund managers have been able to generate "alpha" (returns above the benchmark) because :

- Under-researched stocks: India?s market has plenty of under-the-radar companies.

- Growth potential: Emerging markets like ours offer higher growth opportunities.

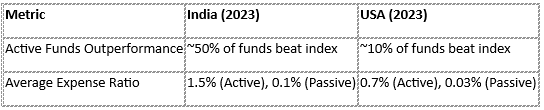

Here?s a quick comparison:

In developed markets like the US, it?s tougher for active funds to outperform because their markets are super efficient. In fact, passive funds now manage nearly 45% of total equity assets in the US.

In India, passive funds currently hold just 15% of the market share (2023), but they?re growing fast.

The Cost Factor: Does It Matter?

Imagine this: You?re planning a family vacation. You have two options:

- A guided tour (active fund): A professional takes care of everything, but it?s pricey.

- DIY travel (passive fund): You plan and manage everything yourself?cheaper, but no frills.

Active funds charge higher fees (1-2% annually), while passive funds come with dirt-cheap costs (0.05-0.5%). Over the long term, this difference can add up, impacting your wealth creation.

So, Which One Should You Choose?

It depends on your investment goals, time horizon, and risk appetite:

- If you trust fund managers and aim for high returns: Go for active funds.

- If you prefer low costs and steady returns: Passive funds are your best bet.

- A balanced approach: Why not have both? Use active funds for mid-cap and small-cap exposure and passive funds for large-cap or diversified portfolios.

Future of Passive Investing in India

Passive investing is growing rapidly in India, thanks to:

- Rising awareness: More investors now understand the benefits of index funds and ETFs.

- SEBI?s push: Regulatory changes encourage cost-efficient products.

- Global trends: As India?s market matures, we?ll likely see a shift toward passive funds, just like in the US.

Think of passive investing as a new recipe in the Indian kitchen. It?s simple, healthy, and becoming a favorite for many. But hey, our traditional curries (active funds) still hold their charm, don?t they? That's why at Mfundz we are recommending to have at list one passive fund to your portfolio as per your risk appetite.

Final Thoughts

Active and passive funds both have their pros and cons. The key is understanding what suits you best. After all, investing is not a one-size-fits-all game.

So, next time you?re deciding between the two, ask yourself: Do I want a chef?s expertise or a simple, reliable buffet? Either way, consistency and patience will be your best friends on this journey.

Happy investing!

Disclaimer : Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.